Western Areas (WSA or the Company) is pleased to report another strong quarterly performance on costs, operational metrics and positive free cashflow generation. Unit cash cost of production was A$2.52/lb of nickel in concentrate for the quarter, being slightly lower than the December quarter. Year to date unit cash costs sit at A$2.46/lb.

Consolidated cash at bank increased by A$75.6m to A$175.5m which includes A$4.4m of funds held by the majority owned FinnAust Mining Plc. Excluding the equity placement proceeds received, the repurchase of A$15m of July 2014 convertible bonds and half yearly convertible bond interest payments, free cashflow for the quarter was A$13.0m.

Total mine production for the quarter was 6,709 tonnes of nickel in ore at an average head grade of 4.4% nickel, with the Flying Fox mine contributing 3,243 tonnes and Spotted Quoll mine 3,466 tonnes of nickel in ore respectively. Nickel in concentrate production and sales were steady at 6,344 tonnes and 6,418 tonnes respectively.

The Indonesian Government's ban on the export of laterite ore has resulted in a rebound in the nickel price on forecast tighter supply fundamentals. With the majority of the nickel price rise occurring in March, quotational period pricing movements have resulted in increased revenue, the cashflow benefit of which will be seen in the June quarter.

The Company currently maintains its full year guidance, but acknowledges potential for outperformance on production and cost metrics.

March Quarter 2014 Highlights:

1. There were zero Lost Time Injuries for the quarter. The LTIFR stands at 1.91 a slight increase on last quarter due to lower hours worked.

2. Pre-consolidated Western Areas cash at bank increased by A$77.0m to A$171.1m. The Company is ready to fully repay the July 2014 convertible bonds outstanding of A$95.2m which will improve Net Profit Before Tax by A$11.7m in FY15.

3. The offtake contract with Jinchuan that was expected to be completed in February 2015, is now forecast to complete in December 2014 due to outperformance sales deliveries and a re-tender may commence early.

4. Costs continue to be well managed, with unit cash cost of nickel in concentrate of A$2.52/lb (US$2.26/lb) for the quarter.

5. Flying Fox mine production was 79,328 tonnes of ore mined at 4.1% for 3,243 tonnes (7.2M lbs) contained nickel.

6. Spotted Quoll mine production was 71,614 ore tonnes at 4.8% for 3,466

tonnes (7.6M lbs) of contained nickel.

7. Total nickel in concentrate sales comprised 6,418 tonnes (14.1M lbs).

8. Exploration efforts continue along the Western Belt between Spotted Quoll and Flying Fox.

- [Editor:Juan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

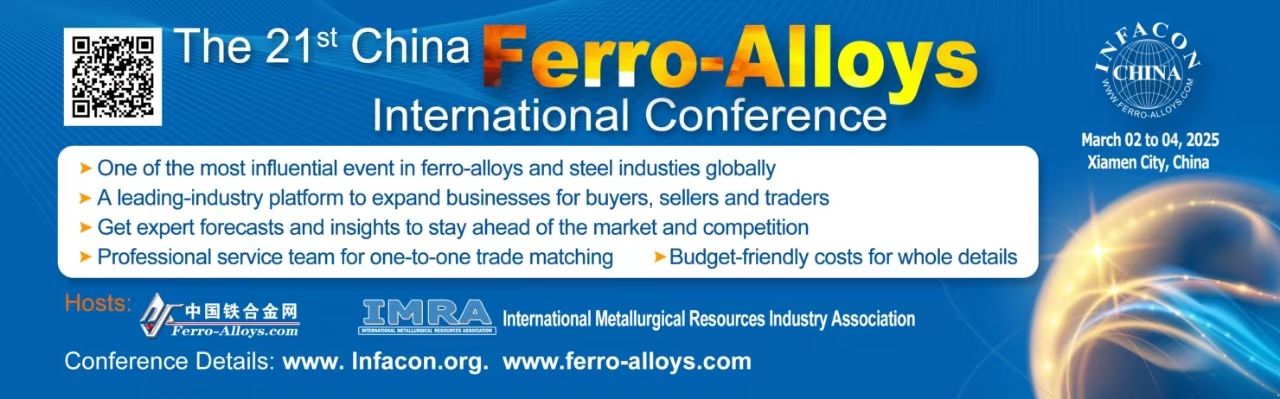

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think