Shares in mining and commodity trader giant Glencore (LON:GLEN) fell more than 9% Wednesday morning, hitting a fresh record low, after it revealed it has swung to a steep, half-year loss and disappointed investors over debt-reduction efforts.

The company’s half-year results show Glencore has been hit hard by falling raw-material prices and lower profit from its trading business, which is threatening its investment grade credit rating..

For the half year to June 30, the group reported a 29% fall in earnings and lowered its profit guidance for its trading arm. It said it was cutting capital expenditure to $5 billion, from its previous target of $6.8 billion, and planning additional cost savings of $400 million.

“Against a challenging backdrop for many of our commodities, we have taken a range of pre-emptive actions in respect of our balance sheet, operations and capital spending in order to preserve our current credit rating,” chief executive Ivan Glasenberg said in a statement.

The Switzerland-based miner said earlier this month that it would take a $790 million charge on oil assets in Chad due to a steep fall in oil prices.

Prices for coal, another key commodity for Glencore, have also been weak and the sector shows no signs of reversing its own supply glut.

And copper, the company’s top earner, is trading at six-year lows, which combined with expectations of dwindling from China, paints a dreary outlook for Glasenberg’s firm.

Shares prices for Glencore, Rio Tinto and BHP Billiton in London for the past month. (Source: Google Finance)

Today’s s stock-market drop wiped $3 billion off Glencore’s market value. The company’s shares have fallen 46% so far this year, underperforming other global

Glasenberg blamed the share price weakness on the ongoing commodity rout and “short-term hedge funds” that he said did not understand Glencore’s business.

“I don’t think those people understand our debt levels work and how we handle it,” he was quoted as saying by FT.com. “As we proved in 2008 when commodity prices came off, we can control out debt levels. We control working capital. We have the tools to do it.”

Glencore is now worth about $33 billion, significantly less than the $61 billion value it had early in the year.

- [Editor:Juan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

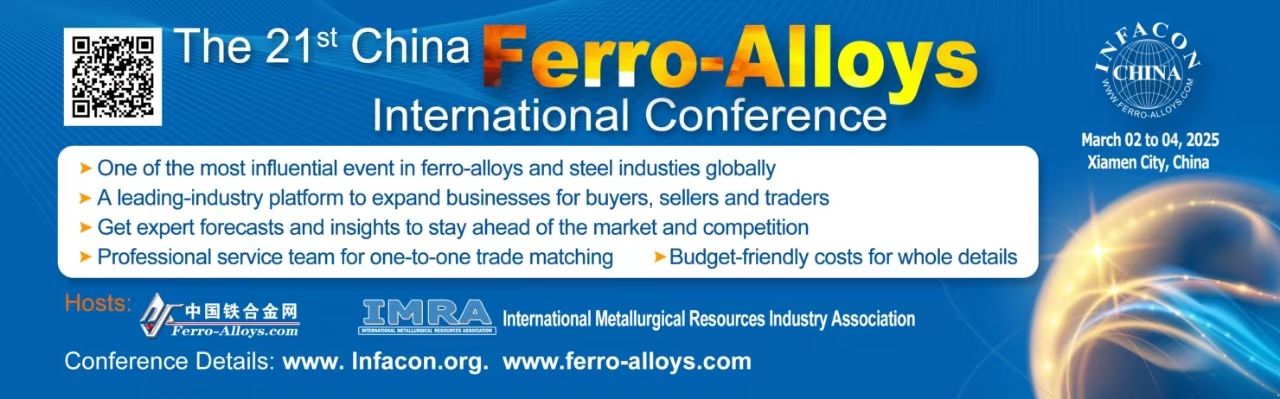

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think