Iron ore prices held steady above $79 per tonne on Tuesday on the back of a strengthening billet market a day earlier, when Chinese steelmakers began stoking production ahead of mandated cuts going into winter.

Ore with 62% content in Qingdao traded at $79.65 per tonne, after hitting $79.93 a tonne on Monday, according to the Metal Bulletin, even though enquiries in the seaborne market have quietened down.

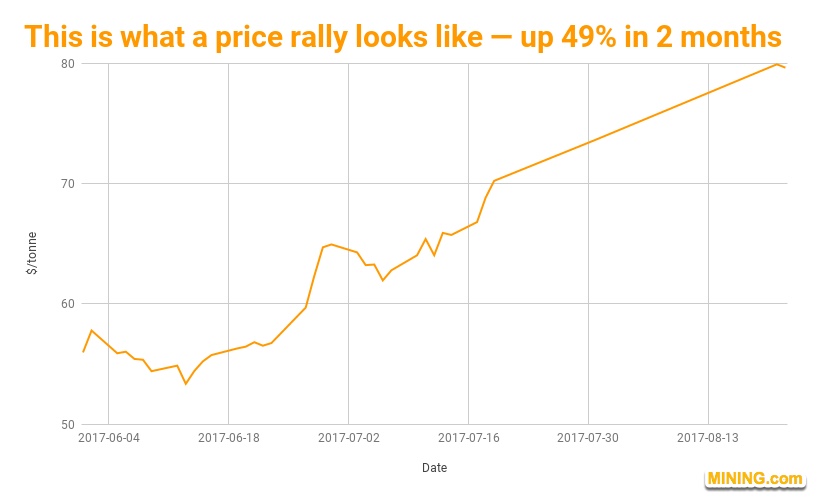

From the recent low of $53.36 a tonne hit on June 13, the benchmark price is now up more than 49% — an impressive return in a little over two months. It also means seaborne is trading higher now than at the beginning of the year.

Despite both pessimistic and conservative predictions about the direction iron ore prices would be headed this year until 2020, the steelmaking material’s ongoing rally hasn’t come as a surprise for some experts.

According to the UN’s trading, investment and development arm (UNCTAD), the upturn began brewing last year and key indicators of demand and supply, seaborne trade and price prove so, as they all made gains through the year.

In a report published late July, the UN body said that although Chinese consumption remained relatively low last year, and prices did not improve for much of the year, a significant shift became evident in the final quarter of 2016.

The analysts expect prices to remain on the high-end for the rest of this year, helped by Beijing’s ongoing efforts to curb low quality steel production and so reduce emissions.

- [Editor:Wang Linyan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think