[Ferro-Alloys.com] Secondary steel producers, which account for almost 60% of India’s steel industry, and mid and smallscale plants are cutting back on output to cope with a demand slump at home.

In the iron ore-rich district of Ballari in Karnataka, at least eight plants that include secondary steel makers like BMM Ispat, Rayen Steel, PGM Ferro Steel and companies such as Mukand and Kalyani Steels — primary suppliers to the auto sector — have scaled back production.

Subdued construction demand is also a trigger for such cutbacks.

Mukand's Hospet (Karnataka) facility has scaled back production by about 15-20% in the last three months. Inventories have increased substantially over normal levels, Mukand said.

Kalyani Steels has had to cut production by as much as 40% over the same period, said a company official on the condition of anonymity.

Many producers said more cuts could be in the offing if demand does not improve.

However, India's oldest steel maker Tata Steel expects demand to pick up in the festive season of the second half of the year and said it will not cut production anytime in the near future. Secondary steel makers that use scrap to produce sponge iron and pellets do not share the same optimism.

The bigger companies are working on inventory management and newer export destinations to cope with fall in local demand.

“Domestic demand has to improve as export opportunities are also shrinking. The industry will not be able to wait for more than one more quarter before deciding to take production cuts,” said Ranjan Dhar, chief marketing officer at Essar Steel. Construction demand typically slows in the monsoon quarter, and this season has been among the rainiest, with at least nine states seeing repeated instances of flooding. According to an industry source, JCB, that produces earth moving equipment for construction, had sold close to 5,500 machines last year during the period between July and August, while this year it sold only 1,500 machines.

“Stock prices reflect that Q2 will remain forever but that is not the case,” said Ritesh Shah, lead analyst for materials at Investec Securities.

“In Q2, there was a problem of contractors not getting working capital for state and central projects, which is why construction activity slowed down.”

Shah also said that as the anti-dumping duties kick in, imports will reduce and locally produced steel will replace the imported quantity. (The Economic Times)

- [Editor:kangmingfei]

Save

Save Print

Print

Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

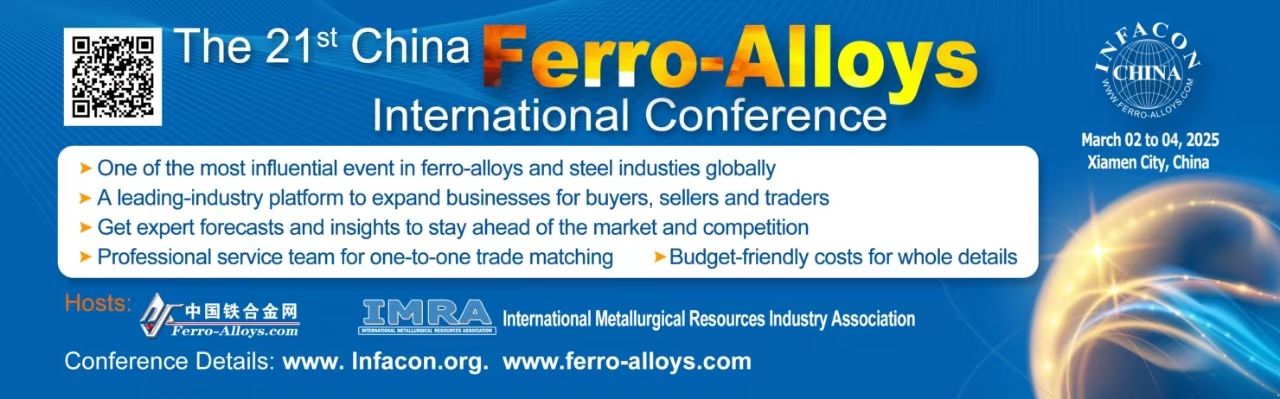

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think