The Board of OM Holdings Limited (“OMH” or the “Company”) provided its DECEMBER 2020 QUARTERLY PRODUCTION AND MARKET UPDATE on 28 January 2021.

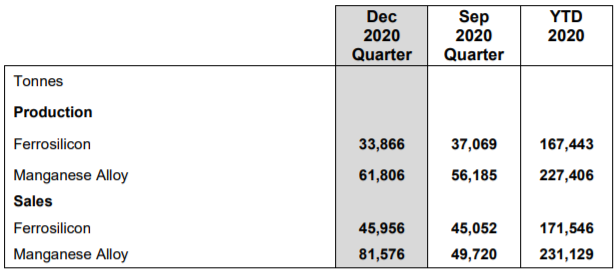

- Production output for the quarter ended 31 December 2020 of 33,866 tonnes of ferrosilicon (“FeSi”) and 61,806 tonnes of manganese alloys comprised mainly silicomanganese (“SiMn”) and high carbon ferromanganese (“HCFeMn”)

- A total of 45,956 tonnes of FeSi and 81,576 tonnes of manganese alloys were sold during the quarter ended 31 December 2020

- A longer than expected hot commissioning and performance testing period for the sinter plant is expected due to the COVID-19 pandemic. The conversion of 2 idled FeSi furnaces to produce manganese alloys was progressed as planned. The commissioning of the converted furnaces was originally scheduled for Q2 2021, but may be delayed depending on when contractors are able to enter Sarawak for equipment installation and performance testing

- Global demand recovery at the end of 2020 raised FeSi prices to Japan to US$1,365 per metric tonne at the end of December, a 29% increase from the end of September 2020

OM MATERIALS (SARAWAK) SDN BHD (“OM Sarawak”)

OM Sarawak owns a Ferroalloy Smelting Plant in the Samalaju Industrial Park in Sarawak, Malaysia (the “Plant”). The Plant consists of 8 main workshops with a total of 16 units of 25.5 MVA furnaces, of which 10 units are allocated for the production of FeSi and 6 units are allocated for the production of manganese alloys. The Plant has a design capacity to produce approximately 200,000 to 210,000 tonnes of FeSi and 250,000 to 300,000 tonnes of manganese alloys per annum. The Plant also consists of a sinter plant that has a design capacity to produce 250,000 metric tonnes of sinter ore per annum.

Commercial operation

As at 31 December 2020, 12 out of 16 furnaces were in operation with 6 furnaces producing FeSi and 6 furnaces producing manganese alloys. Of the remaining 4 FeSi furnaces, 2 furnaces have been idled for the purposes of conversion to produce manganese alloys, with the other 2 furnaces placed on maintenance.

During the quarter ended 31 December 2020, FeSi production volumes decreased by approximately 9% as compared to the quarter ended 30 September 2020. A further 4 FeSi furnaces (out of the 6 that were in operation) underwent annual scheduled maintenance for approximately 34 days during the current quarter, resulting in lower production volumes.

Manganese alloys production volume increased by 10%, mainly attributed to changes in the product mix. Manpower shortages continued to impact the Plant’s ability to operate at full capacity following the second imposition of a Movement Control Order in Malaysia in January 2021 as a result of increased COVID-19 cases in Malaysia.

The sales volume for FeSi increased marginally by 2% while manganese alloy sales volume increased significantly by 64%. Marketing activities picked up during the quarter ended 31 December 2020 following an increase in end user demand which resulted in higher sales and shipment volumes.

The prolonged COVID-19 pandemic and continued global travel restrictions imposed have consequently limited contractors’ activities for the onsite commissioning of the sinter plant, which resulted in a longer than expected commissioning and performance testing period. Full commercial production of sintered manganese ores is now expected to commence only in 1H 2021.

The contract for the conversion of 2 idled FeSi furnaces for the production of manganese alloys was awarded during the current quarter. The equipment was shipped out from China in December 2020 and is expected to be ready for installation during Q1 2021. The commissioning of the converted furnaces was originally scheduled for Q2 2021, but may be delayed depending on when contractors are able to enter Sarawak for equipment installation and performance testing.

As global demand recovered at the end of 2020, steel mills began restocking ferroalloys at the same time, driving demand and raising prices of FeSi to Japan to US$1,365 per metric tonne at the end of December 2020, as reported by Platts. This was a significant increased from US$1,060 per metric tonne reported at the end of September 2020. The increase was also due in part to reduced availability of supply from China due to strong domestic demand, and a surge in global freight rates. Prices continued rising into January 2021 off the back of similar trends and a broader recovery in global demand. Material is typically sold forward with a 1 to 3 months delivery timeframe.

Source: OM Holdings Limited

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think