[Ferro-Alloys.com] OMH: June 2021 Quarterly Production and Market Update

The Board of OM Holdings Limited (“OMH” or the “Company”) is pleased to provide the following update.

HIGHLIGHTS

OPERATING PERFORMANCE

SMELTING: OM Materials (Sarawak) Sdn Bhd (75% owned smelter in Samalaju, East Malaysia)

? Production output for the quarter ended 30 June 2021 of 23,057 tonnes of ferrosilicon (“FeSi”) and 37,691 tonnes of manganese alloys comprised mainly silicomanganese (“SiMn”) and low carbon silicomanganese (“LCSiMn”)

? A total of 30,331 tonnes of FeSi and 50,948 tonnes of manganese alloys were sold during the quarter ended 30 June 2021

? Operations recommenced with an initial 4 furnaces in early July 2021. Production was subsequently ramped-up in stages, with 12 furnaces (6 FeSi and 6 manganese alloys furnaces) currently in production

? Given the prolonged period of operating without home leave for foreign employees due to border closures, it is expected that the pressure on the existing labour force will intensify in Q4 2021 and production plans may be further modified in the absence of any changes in the permitting process of foreign workers

? Loan repayments of US$4.8 million (approximately A$6.4 million) were made to project finance lenders during the quarter ended 30 June 2021

? The final performance testing of the sinter plant and equipment installation works for the furnace conversion project have been deferred to the end of 2021 due to the extension of the lockdown in Malaysia restricting the entry of foreign nationals

OPERATING PERFORMANCE (CONT’D)

EXPLORATION AND MINING: OM (Manganese) Ltd (100% owned Manganese mine in Bootu Creek, Northern Territory, Australia)

? Manganese ore production of 203,791 tonnes with an average grade of 28.08% Mn for the quarter ended 30 June 2021

? Manganese ore shipments for the quarter ended 30 June 2021 were 228,829 tonnes with an average grade of 28.79% Mn

? Based on current estimates, with the declining ore grade and limited ore body, it is anticipated that all mining operations will be concluded within 2021 and processing activities continuing with remaining ore feedstocks

? The Ultra Fines Plant (UFP) produced 3,735 tonnes with an average grade of 26.70% Mn for the quarter ended 30 June 2021

SMELTING: OM Materials (Qinzhou) Co Ltd (“OMQ”) (100% owned smelter and sinter plant in Qinzhou, Guangxi Province, China)

? OMQ produced 16,087 tonnes of manganese alloys and 12,160 tonnes of manganese sinter ore and sold 14,635 tonnes of manganese alloys for the quarter ended 30 June 2021

MARKETING, TRADING AND MARKET UPDATE

? 743,461 tonnes of ores and alloys were transacted in the period from 1 April 2021 to 30 June 2021 as compared to 575,638 tonnes from 1 January 2021 to 31 March 2021, which represented a quarter-on-quarter increase of 29%, in part due to an increase in ores traded from Tshipi and OMM

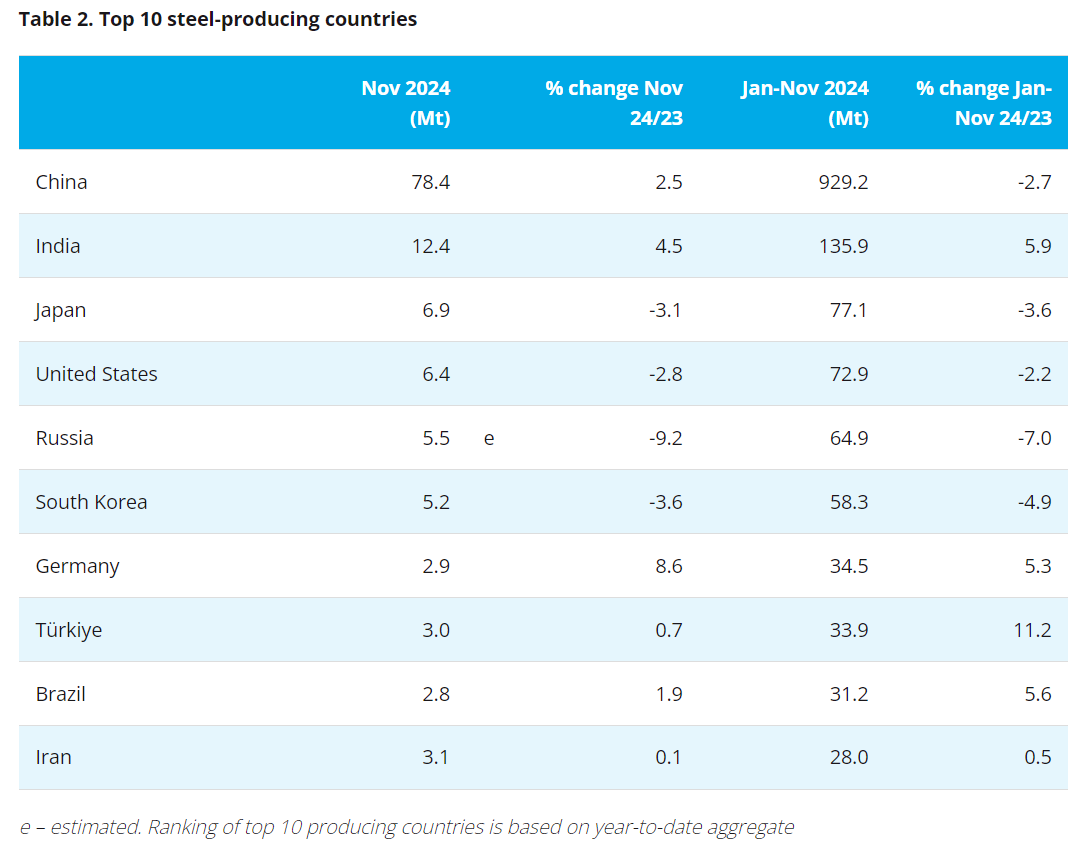

? World crude steel production during April and May 2021 was 353.5 million tonnes, which represented a 21.3% increase as compared to the same period in 2020, signaling a strong rebound from the low base numbers last year due to worldwide lockdowns

? Price of 44% Mn ore closed at US$5.15/dmtu CIF China at the end of June 2021, a slight decrease from US$5.32/dmtu CIF China at the end of March 2021

? FeSi and SiMn prices continued to perform strongly with a sharp increase of 31% and 21% respectively compared to the previous quarter. FeSi prices closed at US$1,920 per metric tonne CIF Japan while SiMn closed at US$1,545 per metric tonne CIF Japan at the end of June 2021

COVID-19 EMERGENCY AND RESPONSE

? The Company continues to prioritise the safety and well-being of employees across all its operations and the surrounding communities whilst maintaining operational resilience in its key business areas. Ongoing improvements in the business continuity plans implemented allows for flexibility in response to the constantly changing environment due to the COVID-19 pandemic

? On 20 July 2021, OM Sarawak donated laptops and personal protective equipment consisting of disposable coveralls, latex gloves, medical gowns and hand sanitizers to the Bintulu Division Health Office. This contribution will facilitate the COVID-19 vaccination programmes and various active case detection activities within the Bintulu Division

OPERATING PERFORMANCE (CONT’D)

CORPORATE

? The Company successfully completed its secondary listing process by debuting on the Main Market of Bursa Malaysia Securities Berhad (“Bursa Malaysia”) on 22 June 2021, with a listing reference price of RM2.57 per share with a total of 16.8 million shares initially made available for trading on the listing day

? As at 27 July 2021, a total of 59,129,887 shares are listed on Bursa Malaysia and 679,493,450 shares listed on the Australian Securities Exchange.

- [Editor:tianyawei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think