Cost Side: In December, the price of semi-coke decreased. At the end of the month, the quotation for small-sized in the Shenmu and Fugu areas was mostly 1100-1210 CNY/T; The factory price of silica in Qinghai and Ningxia regions was 210-260 CNY/T; The price of 70# oxide skin in Shijiazhuang, Hebei was 980-1010 CNY/T; The electricity price in Inner Mongolia was around 0.38-0.40 CNY/kWh.

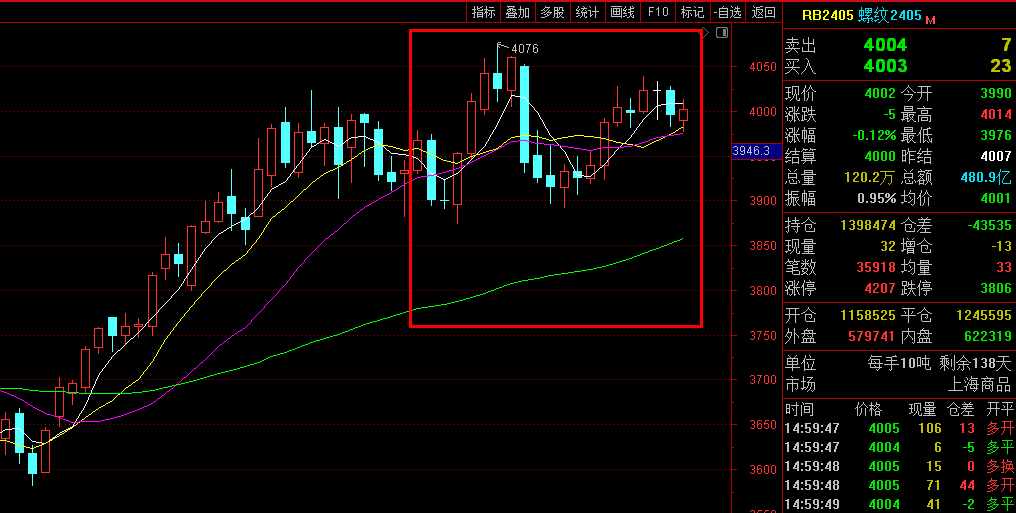

Futures Market: In December, the main contract declined overall. The monthly opening price was 6810, the highest price was 6966, the lowest price was 6584, the closing price was 6656, the settlement price was 6682, the position was 134122, the trading volume was 3668225, and the transaction amount was 124.5059 billion yuan, a decrease of 2.20%.

Spots Market: The overall production was stable, and the impact of relevant policies in Qinghai, Ningxia, and Inner Mongolia regions was not yet significant; Downstream demand has entered a seasonal weakening stage, with continuous snowfall and cold weather leading to insufficient demand for steel. The progress of the new round of steel tender was slow, and the metal magnesium market was downward. The shipment situation was relatively average. The wait-and-see sentiment was strong, and the quotation slightly fell. At the end of the month, the quotation for 72# ferrosilicon standard blocks in the main production areas was mostly around 6600-6700 CNY/T, while the quotation for 75# ferrosilicon standard blocks was mostly around 7100-7200 CNY/T. Considering that some companies in certain regions continued to hover on the edge of losses, and analysis suggested that December to January next year would be a key time point for this round of winter storage. The market had expectations for the demand, and manufacturers had a clear willingness to maintain the prices.

Export Data: According to data of China Customs, in November 2023, China exported 31630.541 tons of ferrosilicon (containing by weight more than 55% of silicon), a year-on-year decrease of 2543.643 tons, a decrease of 7.44%; The month on month increase was 3676.006 tons, an increase of 13.15%. From January to November 2023, China exported 25281.584 tons of ferrosilicon (containing by weight ≤55% of silicon), an increase of 137.593 tons year-on-year, or 0.55%.

Steel Market: The weather has turned cold and the temperature has dropped. In December, downstream steel demand has entered a seasonal weakening phase. The market's acceptance of high priced products was limited, and the actual transaction situation was not good. According to data from the National Bureau of Statistics, from January to November 2023, the ferrous metal industry achieved a revenue of 7630.35 billion yuan, a year-on-year decrease of 2.3%; The operating cost was 7291.03 billion yuan, a year-on-year decrease of 2.7%; The total profit was 40.04 billion yuan, a year-on-year increase of 275.6%. Looking ahead to 2024, experts predicted that the demand for steel in 2024 expected to remain at the level of 2023; It was expected that there would be a certain degree of decline in export growth in 2024, and they believed that the market in 2024 would be more optimistic than in 2023.

Metal Magnesium Market: The domestic magnesium metal market stabilized first and then declined in December. In the early stage, the factory had a strong willingness to raise prices due to cost support. The mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 20500-20600 CNY/T. However, downstream demand has not improved, in addition, many northern regions have been affected by snowfall and cold weather, leading to increased pressure on factory shipments. Coupled with the fact that some enterprises in the Fugu region have started to resume production, the imbalance between supply and demand was gradually reflected. Some enterprises slightly reduced prices, and the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 20200-20300 CNY/T. Under the lack of obvious positive factors, the pressure on the magnesium market still existed, but with cost support, it was expected that the price reduction would be limited. Pay attention to changes in demand and follow up on transactions.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think