World nickel prices could receive a much-needed boost as Indonesia implemented a ban on exporting raw mineral ore, which could see mining giant BHP Billiton Limited’s prospects of selling its nickel and bauxite assets lift.

BHP produces a sizeable amount of nickel in both Western Australia and Colombia but has made its intentions clear that it wishes to exit the industry. While nickel prices could well receive a boost in the near-term, it is unlikely that it will sway the company’s desire to exit. It could instead create a more favourable environment to sell its assets. UBS analyst Glyn Lawcock said: “A price spike in nickel does create opportunities for disposal of the business at a better than expected price.”

Should it sell its assets at a reasonable price, it could increase the chances of the company entering a share buyback program before the end of the year, in addition to increasing its dividend distributions.

While BHP’s shares rose 12c on Monday following the news, it was Australia’s other nickel stocks that enjoyed the most significant gains of the day. Western Areas Ltd rose 8.9% and gained a further 4.3% on Tuesday. While Sirius Resources N.L and Panoramic Resources Limited also recognised strong gains both today and yesterday.

BHP currently offers an attractive fully franked 3.2% dividend yield, but there are even better opportunities for 2014!

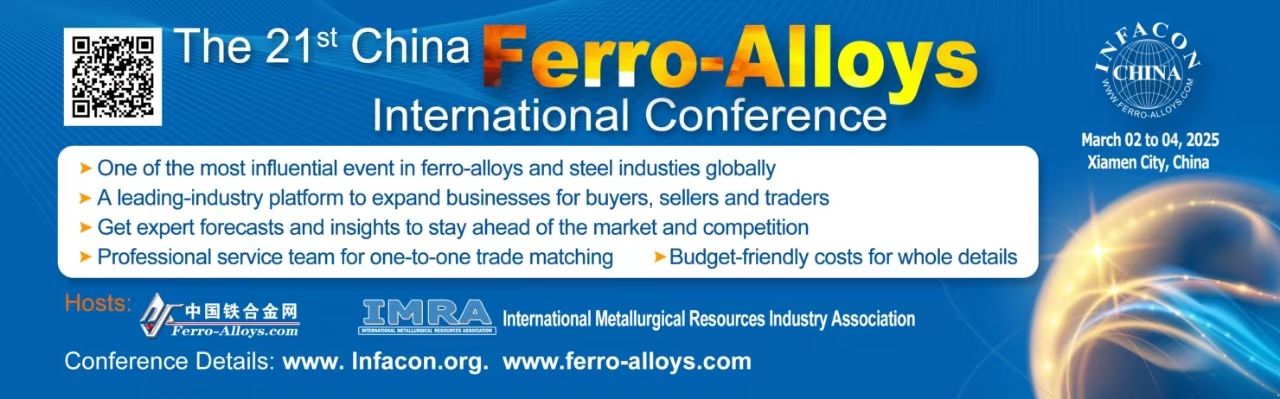

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:editor]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think