A few of the North American silicon metal contracts have been firmed up for 2012. Those that had fixed prices were below $1.50 on an in warehouse basis for regular-grade material. In addition, formula sales contracts to large buyers generally had higher discounts than compared to 2011.

Along with the collapse of the polysilicon market, the silicones segment looks decidedly weak.

Dow Corning it has yet to report its third-quarter results, Corning, 50% owner of Dow Corning, at its third-quarter analyst call said “demand for silicone products has slowed significantly” with accompanying price declines in silicones. The usual soft spot, metallurgical grade, is holding up best. However, that segment is also suspect on expected falls in US auto production.

Dow Corning’s fourth-quarter equity earnings could be down as much as 40% sequentially, due to both lower silicones demand and pricing as well as lower polysilicon pricing and lower solar demand, Corning said. Dow Corning’s third-quarter sales were around $1,300-million vs. $1,668-million in the second quarter and $1,515-million in the third quarter of 2010 where stronger polysilicon sales were offset by weaker silicones sales quarter to quarter.

Corning’s equity income from Dow Corning was $89-million in third quarter of 2011 vs. $95-million in second quarter of 2011 and $97-million third quarter of 2010, noting higher raw material costs and lower compensation costs in third quarter of 2011.

Dow Corning fully consolidates Hemlock Semiconductor, its 63.25% owned polysilicon subsidiary, which represented around 25% of Dow Corning’s 2010 sales.

The EU may be getting a changed circumstance case that could result in the elimination of dumping duties against Chinese silicon metal imports. After China’s Bluestar purchased Elkem, the door has been open to a changed circumstance case even though Elkem is not a voting member of the EU; instead the country has a “cooperation” agreement with the body.

The real battle may take place even before the case reaches the EU. Both Elkem and Ferroatlantica, the largest European silicon metal producer, are members of Euroalliages, the European ferroalloy producers association. Until now, Euroalliages has fought for the penalty duties. “It could divide the group,” another member said.

In addition, Ferroatlantica is planning to build a large silicon smelter in China and if it imports 10% of that plant’s capacity to the EU, Ferroatlantica is no longer considered a European silicon producer, trade lawyers say.

While the duty is only 19% for most Chinese sellers, it has proven increasingly ineffectual. More Chinese silicon is being smuggled out of China to avoid the 15% export duty that lowers to the total cost to European buyers.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

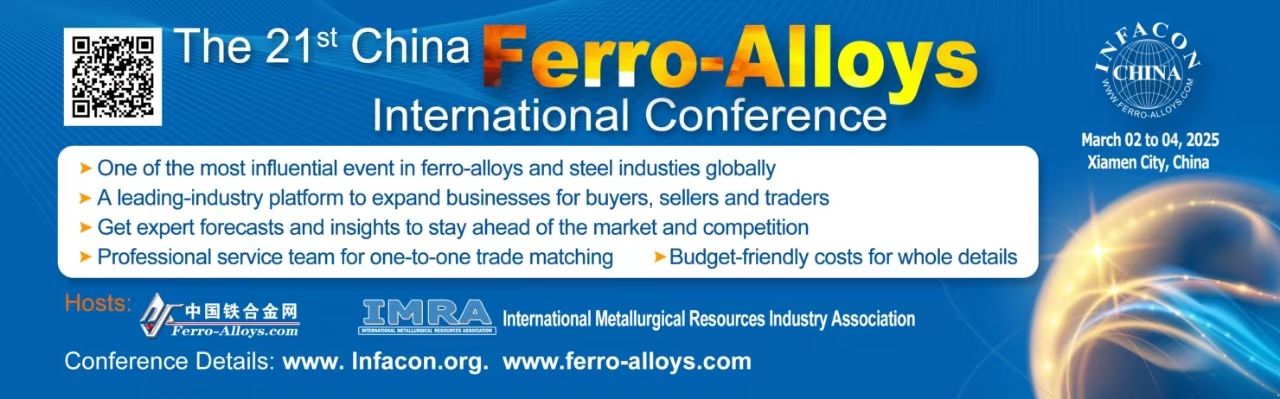

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think